Why Does iGaming Grow During Crises?

Recessions hit hard but not for iGaming. While other industries cut back, this one levels up. What’s driving the growth?

22 May, 2025

Why Does iGaming Grow During Crises?

If there’s one thing economic crises tend to do, it’s expose the fragility of certain industries. But not all markets shrink in tough times. Some, like iGaming, actually thrive.

From the 2008 financial meltdown to the COVID-19 pandemic and the recent inflation-driven downturns, the iGaming industry has shown a remarkable ability to adapt, evolve, and even grow when most other sectors are cutting back.

So, what’s behind this unexpected resilience?

Crisis = More Screen Time (And More Players)

In times of uncertainty, people look for affordable entertainment and distraction, especially when budgets are tight. iGaming naturally fills that gap, not just as a way to pass time, but as an accessible form of engagement that fits into nearly any lifestyle.

- 2008 Financial Crisis

Back in 2008, when the global financial crisis shook almost every industry, traditional gambling venues took a big hit. People simply had less money to spend on leisure. But iGaming didn’t just survive, it adapted. Many platforms moved online, cutting overhead costs and reaching wider audiences without the need for physical locations. In fact, online betting revenues actually grew by 30% during the recession. Mobile apps and smart, targeted marketing played a big role in that growth. It was a perfect example of how the industry used tech to turn a crisis into an opportunity.

- COVID-19 Pandemic

When the world went into lockdown in 2020, in-person entertainment took a massive hit almost overnight. But iGaming didn’t miss a beat. The industry quickly doubled down on its digital offerings, rolling out live dealer games, virtual sports, and other engaging formats to keep people entertained at home. According to the European Gaming and Betting Association, the industry saw a 25% revenue jump between 2020 and 2021 as people looked for safe, online alternatives. Smart features like AI-powered personalization played a big role in keeping users coming back, proving just how fast and flexible the iGaming space can be when the game changes.

- 2025 Economic Challenges

2025 has been anything but predictable. With inflation still hitting wallets and ongoing geopolitical tensions shaking global markets, a lot of industries are feeling the pressure. But iGaming? It’s holding strong and even finding ways to grow.

Instead of scaling back, many platforms have leaned into innovation. We’re seeing better mobile experiences, quicker and more secure payment options (especially with crypto), and smarter, more personalized gameplay thanks to AI. At the same time, operators are getting creative by offering more flexible bonuses, loyalty programs, and subscription-style models that let players stay in control of how much they spend.

Behind the scenes, businesses are tightening up operations, investing in smarter marketing, and forming strategic partnerships to stay competitive. And while some markets are slowing down, others are opening new doors for expansion.

A prime example of this resilience is BetMGM, one of the leading sports betting and iGaming operators across North America. In the first quarter of 2025, the company reported $657 million in revenue, marking a 34% increase year-over-year. This growth was driven by a 68% rise in online sports betting revenue to $194 million and a 27% increase in iGaming revenue to $443 million.

BetMGM also shared some interesting insights that show the strength of the iGaming industry amid ongoing economic challenges:

- The company hasn’t noticed any significant issues with player behavior or changes in casino game models, despite inflation and increased costs.

- Active player days for online casino sessions have increased by 39%, showing a strong, organic engagement in the market.

- While customer acquisition costs haven’t risen and have even leveled off, BetMGM is focusing on their high-value players—those that bring in more revenue without the need for additional promotions. This speaks to strong organic growth and a sustainable customer base.

- Casino operations are the main revenue driver for BetMGM, highlighting the importance of high-quality game offerings and strategic provider relationships

- Looking at long-term prospects, BetMGM doesn’t foresee taxes posing a significant issue. While short-term impacts could occur, the company believes the new regulatory framework will ultimately help eliminate black and gray markets, benefiting licensed operators in the long run.

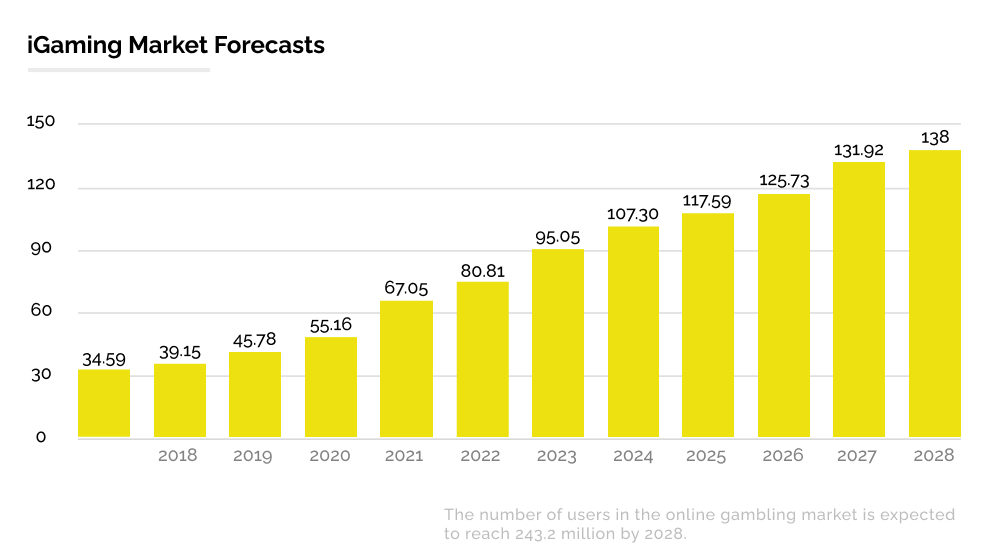

iGaming Market Forecasts

According to Statista, the Online Gambling market worldwide is projected to reach a revenue of US$117.59 billion by the end of 2025. This is expected to result in a market volume of US$138.10 billion by 2028, with an annual growth rate (CAGR 2024-2028) of 6.51%.

The number of users in the online gambling market is expected to reach 243.2 million by 2028.

New Markets, New Rules, Big Growth

One of the biggest reasons iGaming continues to grow is regulation. But not the kind that shuts things down. Quite the opposite. We’re seeing more and more countries introduce clear, structured laws that actually enable online gambling to flourish – safely, transparently, and responsibly.

This shift is especially visible in regions where the conversation around responsible gambling has taken center stage. Transparent regulation and legal market access turn out to be far more effective than unregulated grey zones or closed markets. When there are no clear rules, the market doesn’t disappear, it just goes underground. But when governments create open, well-regulated environments, everyone wins: players stay protected, businesses play fair, and the state gets its share too. By attracting serious operators they unlock new tax revenue and innovation opportunities.

- Netherlands: Tighter Rules to Protect Players

Since legalizing online gambling in 2021, Dutch authorities have built their entire licensing model around player protection. Operators must follow strict rules aimed at minimizing addiction risk and shielding vulnerable users. That includes:

- A complete ban on offering credit to players or acting as intermediaries between them and lenders.

- Strict advertising guidelines. Marketing materials can’t imply that gambling is a solution to financial problems.

- Operators are required to monitor user activity for signs of risky behavior, such as frequent play sessions or rapidly increasing deposits.

- If such patterns are detected, the operator must intervene either by pausing the player’s access or offering tools to limit their gambling.

- They’ve also set default monthly deposit limits (around €400/month)

- And, of course, a zero-tolerance policy for underage gambling (players under 18 are strictly prohibited).

These steps aren’t just for show. According to a recent report by the Center for Responsible Gaming, the Dutch government’s approach has already helped stabilize the market, boost player trust, and drive sustainable growth.

And it’s not just the Netherlands. Across Europe and the Americas, responsible gaming regulation is becoming a gateway, not a barrier, to market expansion.

- Sweden: Mandatory Deposit and Betting Limits

Sweden’s gambling regulator, Spelinspektionen, has enforced rules requiring all licensed platforms to offer players the ability to set daily, weekly, and monthly limits on their deposits and wagers.

How it works:

- Users must set these limits before they can start playing.

- Once a limit is reached, the platform automatically blocks further play.

- It’s not optional — it’s built into the user flow.

A great case of preventive protection at the platform level.

- United States: State by State, Responsible iGaming Is Gaining Ground

In the U.S., over half the states still ban online casino games, but momentum is building.

Unlike Europe, the U.S. doesn’t have a centralized gambling regulator – but that hasn’t stopped individual states from taking real steps toward responsible play.

For example, New Jersey and Pennsylvania require licensed operators to implement self-exclusion tools and player limits. But more interestingly, U.S. platforms like FanDuel, DraftKings, and BetMGM are starting to invest in real-time behavioral analytics. These tools monitor deposit spikes, session lengths, and betting frequency to spot early signs of addiction. Some operators even send automatic prompts when a player’s behavior becomes risky — nudging them to take a break or set tighter limits.

States like New York and California are actively debating legalization, with one major condition: operators must prioritize responsible gambling. That means more transparent data usage, self-exclusion tools, deposit limits, and clear ways for players to stay in control.

In fact, companies that lead in this area tend to get rewarded. A 2024 GBGC report shows that operators with strong responsible gaming programs saw up to 15% higher revenues – not because they attract more users, but because they retain them better. Users trust platforms that put safety first.

- Player Protection Is Going Global

Even Brazil, which officially regulated iGaming in 2023, is pushing operators to follow similar standards as they enter the market. And Latin America as a whole is watching closely.

This wave of change is backed by real-world moves from both companies and regulators.

In early 2025, the UK Gambling Commission launched a new set of affordability checks to ensure players aren’t betting beyond their means.

Germany implemented a national player exclusion database, OASIS, allowing individuals to self-ban from all licensed platforms in the country.

Australia launched a centralized tool called BetStop, which lets users self-exclude from every licensed gambling platform in the country — for anywhere from 3 months to life.

What’s becoming clear is this: responsible gambling is no longer a side note, it’s the price of admission. But rather than slow down growth, it’s doing the opposite. By building safer, more transparent ecosystems, countries are opening the door to long-term iGaming success.

For tech companies and investors, this signals a massive opportunity. As more regions go legal with built-in accountability, the potential for expansion keeps growing and it’s not just about profit. It’s about building a better, smarter, more sustainable industry from the ground up.

The Crypto Connection

Let’s not ignore the role of crypto. It’s been a game-changer for iGaming, especially in markets where traditional banking doesn’t quite cut it.

According to a recent SOFTSWISS report, more than half of iGaming businesses consider cryptocurrency a key driver for global expansion. And it’s not just Bitcoin. Altcoins like Ethereum and Litecoin are becoming increasingly popular, with their share of crypto bets jumping from 25% to over 47% in just one year.

Crypto offers faster payouts, privacy, and access to players who don’t want to or can’t use traditional banking systems.

It’s Not Just About Winning Anymore

Another trend that exploded during recent downturns? Social gaming.

Leaderboards, achievements, multiplayer tournaments—these features are turning solo gaming into a shared experience. The social layer helps keep players engaged longer, which in turn drives platform growth.

Platforms using gamification have reported up to a 30% boost in engagement. In short, the more fun and community you build into the game, the more likely players are to stick around.

Final Thoughts

So why does iGaming keep growing even when the economy shrinks?

Because it adapts fast, leans into tech, and understands what players want: convenience, security, engagement, and entertainment.

Whether through mobile-first platforms, immersive tech, crypto integration, or social features, the industry keeps moving forward. If you’re in tech, this is one space you definitely want to keep an eye on because when most industries are slowing down, iGaming’s just getting started.

Let's work together to make your project a success

Contact usLast News

Thank you!

We’ve received your contact request and will contact you soon

Something went wrong

We couldn’t receive your contact request. Please try again later.